Avoiding Basic Walmart Deductions

Deductions, or chargebacks, can hit your wallet hard. Some of them you can dispute, but others are far more difficult. In the end, it’s best to just avoid them altogether.

Here are some of the most common Walmart deduction codes that you may see and some best practices on ensuring you don’t see them again.

Codes 10 and 11

Code 10 is “Price Difference as Documented” and code 11 is “Pricing Overcharge”, meaning that in the first case, an allowance is being applied incorrectly leading to a higher invoiced amount than Walmart expects, and in the second, the item’s price on the invoice isn’t correct. Walmart will deduct the difference in the prices as long as the invoice is for more than the purchase price. If it ends up the difference was not in your favor, Walmart will not reimburse you.

Here are some tips for avoiding code 10s and 11s:

- Review the purchase order (PO) for correct cost and allowances information before filling the order.

- Review the EDI data and PO data to ensure what is sent and received matches the allowances agreed upon in supplier agreement (OSA).

- Review for correct cost, allowances, units, and weight information.

- Confirm that invoices are being generated correctly (i.e., check your EDI 810s). Code 10s and 11s often come from incorrect EDI data.

- Do not ship product if the information on the PO is not correct. Instead, Walmart recommends contacting the buying department to request a price correction.

It is a best practice to keep a table of all pricing changes and their effective dates so that you can quickly identify invalid code 11s.

Deductions are based on the PO price, so if the pricing on the purchase order (EDI 850) is incorrect, do not ship the order and contact your buyer immediately. The buyer will need to make changes on a purchase order and either send an updated EDI 850 or cancel and send a new EDI 850. Typically, disputes for pricing discrepancies require the buyer’s approval, making them more difficult to win.

Code 13

Code 13 is “Substitution Overcharge” meaning you invoiced for one item number, but Walmart received a different item. Walmart will file a code 13 for the difference in the price of the items on the invoice.

Here are some tips for avoiding code 13s:

- Merchandise should be shipped and billed according to the purchase order.

- Do not substitute items when filling a PO. Instead, make sure to fill the PO exactly as ordered. If you do not agree that the requested items ordered should go into this shipment, work with your Replenishment Manager (RM) or the buyer on requesting an updated PO.

- Make sure your packaging and labeling for different items are distinct so that it is clear to the receiver which items were shipped. Code 13s are sometimes filed when the receiver mistakenly identifies the items received.

Code 13s are notoriously difficult to dispute, so hopefully, this will help you avoid them.

Codes 22 and 24

Code 22 is “Goods Billed not Shipped” and code 24 is “Carton Shortage/Freight Bill Signed Short” meaning that the quantity of an item on the invoice does not match the quantity of that item in the shipment or the order was signed short by the distribution center. Typically, this occurs when the order has been short shipped or when the bill of lading shows more items than what was counted and the proof of delivery was stamped short. Walmart will deduct the cost of the missing or falsely invoiced items for code 22s and 24s.

Here are some tips for avoiding code 22s and 24s:

- Be sure that packaging does not obfuscate items being shipped.

- Be sure the quantity of each line item invoiced matches the quantity shipped.

- Confirm that fulfillment information is correctly flowing to the warehouse, i.e. check your EDI.

- If you don’t agree with the quantity ordered, do not short ship. Rather, coordinate with the RM or the buyer to request an updated purchase order.

- Confirm that your items are set up correctly.

- For example, if Walmart requests that product is shipped as eaches on the Purchase Order (EDI 850), then make sure that your items are set up as eaches and that the Invoice (EDI 810) also reflects eaches.

- If there are any errors on the purchase order then do not ship; instead, reach out to the RM to request an updated PO to reflect the proper setup.

- It is a best practice not to commingle inventory for different purchase orders. Walmart expects one PO shipment per pallet or per box unless you have a written agreement with the RM stating otherwise. If you do include multiple POs in a shipment you must clearly separate them, though it is still not recommended as this is one of the most common reasons for invalid shortage claims.

- Ensure that all cases are shipped as noted on the freight bill. Again, do not short ship if you do not agree with the quantity ordered on the PO. Ask your RM or the buyer to issue a new PO with the quantities you would like to ship.

- Be sure all cases ordered on PO are shipped complete. Get with your warehouse or carrier to make sure that they are loading your shipments in full.

- Be sure the driver notes the case count on the bill of lading. The bill of lading must show an accurate count of the cases in the shipment, so make sure that they are marking everything correctly.

Code 25

Code 25 is “No Merchandise Received for Invoice”, meaning that Walmart claims to have received no shipment at all for the PO for which you are invoicing. This usually occurs when the Invoice was issued too early (on before the delivery date). Walmart will deduct the cost of the entire invoice for code 25s.

- Be sure to not invoice before the order is shipped. If Walmart receives an invoice for goods not yet received they will issue a code 25.

- Be sure to fill the order before the delivery date. Otherwise, you may invoice before the buyer receives the shipment.

- Do not re-invoice once goods are delivered, rather prove that the order was delivered. If you re-invoice after goods are received Walmart will likely hit you with a code 30 for duplicate billing.

Codes 22, 24, and 25 are fairly easy to dispute, as, for invalid claims, they just require a signed proof of delivery and/or a bill of lading (depending on whether you are Collect or Prepaid), along with the PO and invoice.

Codes 50-59

The codes in the 50s are for allowances and discounts, meaning that there is an issue with the agreed-upon reduction in cost to the retailer. These occur when a particular allowance is listed on your Online Supplier Agreement (OSA), but not on the invoice. Here is the full list of codes 50-59:

- Code 50: “Advertising Allowance”

- Code 51: “Promotional Allowance”

- Code 52: “Volume Allowance”

- Code 53: “Truckload Allowance”

- Code 54: “Warehouse Allowance”

- Code 55: “New Location Allowance”

- Code 56: “Early Buy Allowance”

- Code 57: “Quantity Discount”

- Code 58: “DSDC Allowance” (This is a direct-to-store, shipped through distribution center allowance.)

- Code 59: “Defective Merchandise Allowance”

To avoid allowance deductions, you should first check your supplier agreement to make sure you are using the correct allowances on your invoices. If that appears in order, make sure that your EDI 810s are applying the allowances correctly. Work with your EDI provider to make sure that the correct data is being sent.

You can dispute allowance deductions as long as you can prove that the allowance was on the invoice and the allowance matches what is on your OSA. A common scenario for invalid codes in the 50s is that your OSA states that an allowance is supposed to be given off-invoice, but your EDI provider is actually giving the allowance off-line item. Disputing through your buyer and showing that the correct amount was already withheld can often overturn the deduction.

How SupplyPike Can Help You Avoid Deductions

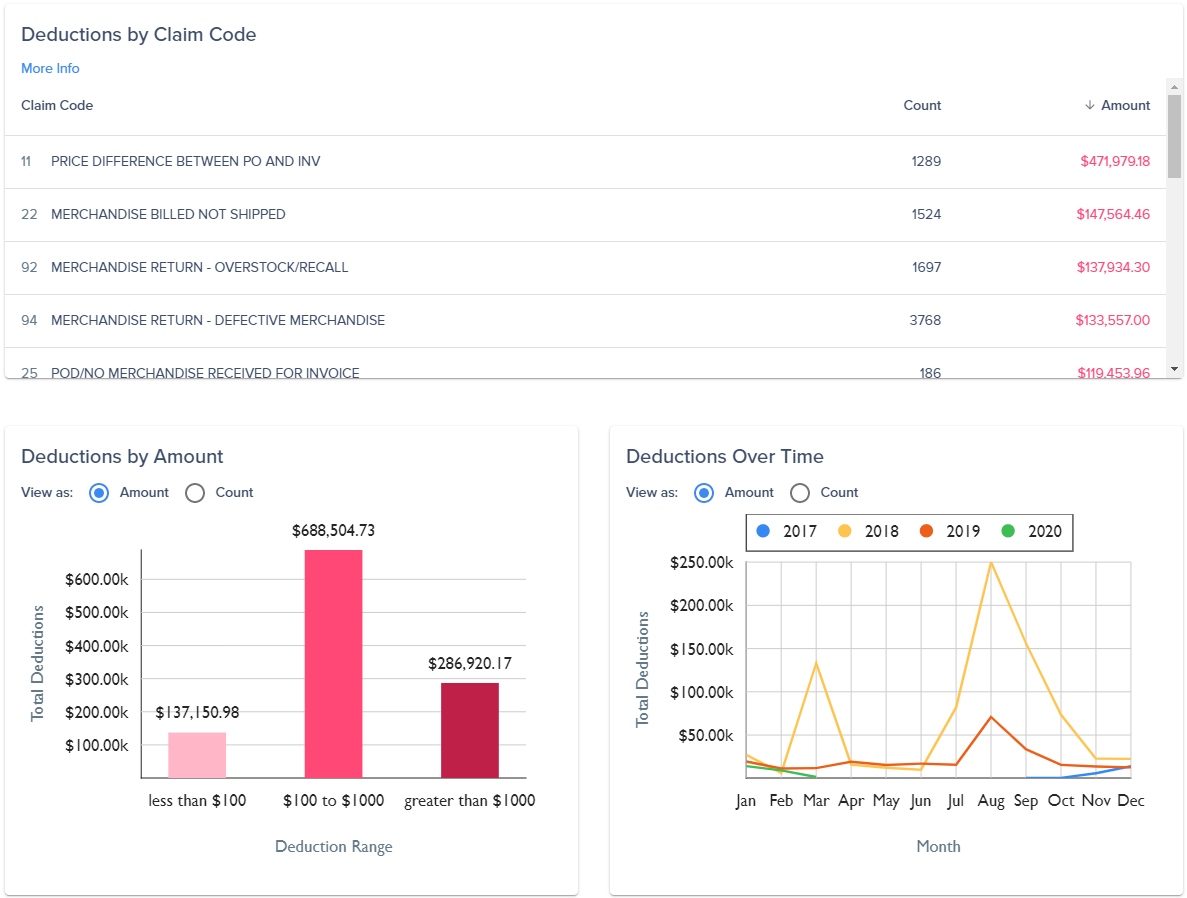

With our software, SupplyPike takes the guesswork and tedium out of managing deductions. We make it easy to understand every deduction and even give you the power to submit disputes automatically while our software automatically determines the validity/invalidity of your fines. From high-level dashboards to detailed data from claims, checks, invoices, and purchase orders, you’ll have unprecedented insight and control of retailer deductions.

SupplyPike dashboard

You can start for free and get visibility on all of your deductions. Schedule a demo today!

Related Resources

Written by The SupplyPike Team

About The SupplyPike Team

SupplyPike builds software to help retail suppliers fight deductions, meet compliance standards, and dig down to root cause issues in their supply chain.

Read More

About

SupplyPike helps you fight deductions, increase in-stocks, and meet OTIF goals in the built-for-you platform, powered by machine learning.

View SupplyPike's Website